[0:00] Like you know how in Toy Story, don't forget to pack your angry eyes.

So do I have my lava-based room behind me? Yes, I do, because this is going to be an absolute passion fest.

Do not try to fall asleep to this live stream.

We're going to do a little bit for the general population, and then we're going to retreat to the Elysium clouds of donor-only in just a little while.

Just a little while. But we're going to start with what the hell is going on?

Well, nothing too shocking, nothing too surprising.

So let's get straight to the meat of the matter, straight to the heart of the matter.

So what's going on Bitcoin?

So Bitcoin, as of 3.47 p.m. Eastern Standard Time, 8th January 2024, is up.

This is all Canadian, $36.91 in 24 hours.

So it's currently trading at $62,697.56, up from a little bit earlier today, from just a shade over $60,000.

So what is going on? Well, quite a lot.

Quite a lot. Listen, while vacuuming the beach house, you haven't sold your beach house to buy Bitcoin. What are you doing?

[1:22] All right. Let's get straight into it. So what's going on?

Well, just in general, and a lot of this is rumor, none of this is financial advice, don't buy or sell anything based upon what I'm saying, obviously, do your own research, all that kind of stuff.

But the rumor seems to be, how much of it is confirmed, of course, is unknown, but the rumor seems to be something like this, that a bunch of the ETFs, exchange-traded funds, that were submitted by a variety of companies to the SEC are imminent in their approval status. Imminent in their approval status.

It's Monday. The idea is that they will be approved officially by Wednesday.

[2:02] And they will start allowing investors to invest in Bitcoin by Friday. Friday.

This is a massive peak and depth and power and understanding, not in Bitcoin, not in Bitcoin, but in the fundamental liberation of the species from the money chain.

The money creators, the money lenders, the currency by fear to the currency by law predators on the history of the species.

Please understand what a moment in time this is. Of course, you know, the price is exciting. That's all cool.

I get all of that. Nothing wrong with that. Nothing wrong with being a little chirped about the price, but.

[2:49] Bitcoin, in its most fundamental manifestation, is life itself.

Hyperbole, you say? I strenuously disagree. I did this speech many, many years ago. I did many of these speeches.

Bitcoin means the end of war. Bitcoin means the end of intergenerational predation.

Bitcoin means the end of vote buying.

Bitcoin means the end of the endless worms through the casket theft of your savings through inflation.

Bitcoin means the end of useless as tits on a bull government programs of vote buying and subjugation.

Bitcoin replaces the witch doctor physics of political pull with the objective science of uncontrolled currency.

Uncontrolled, unmanaged, yet highly disciplined money. Bitcoin Bitcoin ends all but the most defensive of conflicts.

[3:52] Bitcoin ends the avenue for some of the smartest among us to make their pretend money by pillaging the stored value of everybody else.

Bitcoin casts mathematical geniuses back into the workplace where they can actually produce something of value rather than skirt around on the witch broomsticks of fiat currency on the high Olympian mountains of endless predation.

Bitcoin is life. Look, in the 20th century alone, a quarter of a billion people were slaughtered by their own governments, most of which were funded, all of which were funded by fiat currency.

That's just democide, not even counting the wars. Can you have wars of aggression without Bitcoin? You cannot.

With Bitcoin, the money is yours until you say otherwise. Do you follow?

[4:54] Your money is yours until you say otherwise.

Nobody can come in and inflate it away. Nobody can shut down your bank account because you are in close proximity to a snow-covered bouncy castle.

Your money is your own, your life is your own, your savings are your own, your planning is your own, your essence is your own, you're out of the rolled paper jail of mere manipulated fiat.

[5:36] This is the breaking out, There's the final platonic pledge to escape the matrix, to escape the cave, right?

You know the story. I talked about it in my presentation, The Truth About Plato, my four-hour-plus opus. You can find that at fdrpodcast.com.

What did Plato talk about?

He said most people are not looking at the world.

They're not looking at things.

They're not even looking at the shadow of things.

They're looking at manipulated imagination which is called propaganda most people are trapped in a cave, there's a fire there are a bunch of shapes in front of that fire they're looking at the shadows of the flickering shapes manipulated by others on the cave wall, they are nowhere close to reality and they don't even know that they're mad, They're nowhere close to reality, and they don't even know that they're mad.

[6:42] Now, the traditional Plutonic tale, which we've seen played out in this conversation over the last 18 years and in countless other conversations, though few with this much scope and reach, is that the philosopher begins to doubt that the shadows on the wall of the manipulated shapes are real.

He stops looking at the wall, and then he sees the shapes, and then he stops looking at the shapes, and he sees the fire, and then, past the light of the fire, illuminated by the light of the fire, he sees, by the fire, he sees a passageway, and that passageway leads up, and up, and out.

He tears himself away from the hypnosis of the screens, right?

Screens. Fake reality and a screen is something to keep something out, right?

A screen door to screen people to have standards.

So reality is screened out by the screens.

[7:48] Once he starts looking away from the hypnosis of the propaganda, he sees a passageway on the far side of the fire that leads up and out, and he begins to climb those stairs.

[8:02] And instead of looking at an artificial fire and manipulated objects, he goes out up into the world, his eyes agonizing like you've just stumbled out of a mid-afternoon film noir festival into bright sunlight.

And he sees the world that is, the unmanipulated world, the uncontrolled world, the world of empiricism, the world of facts, the world of reality, the world of objectivity, the world of truth.

The unmanipulated world.

[8:34] Bitcoin is to fear it as manipulated, fear-mongering horror stories are to the simple experience of the natural world.

Now in the past the man usually the man who sees the world for what it is no manipulation no fire no screens no propaganda, no shadows the things themselves, what does he do? he goes back down he goes back down into the cave and tries to tell people that they live in a false, manipulated, unreal, made-up matrix metaverse of lies, control, and propaganda.

And the people say, you're crazy, man. These shadows are real.

I don't know what ayahuasca drug trip you've been on.

Riding Cernovich's bouncing nutsack through the Mojave Desert of confusion.

Confusion, but that's real. Whatever you're talking about is not real.

And the man insists that what they're watching is a manipulated illusion and tries to get them to mount the stairs to the real world, to unplug.

[10:03] And all the people manipulating the masses say to to the truth teller or say about the truth teller, he is an evil man who wants to lead you to your death and doom and rouses the population to attack the truth teller rather than the constant liars.

I mean, we've all had this situation in the world, haven't we?

All had the situation, both in our personal lives or online lives, you name it, where you tell the truth to some people and they get mad, not at the people who've lied to them for eternity, but for the person who tells them the truth.

But fear changes everything. Sorry, Bitcoin changes everything relative to fear. And I'll tell you why.

[10:53] What breadcrumbs have been available to lead people to the light in the past?

I say again, this is absolutely foundational and essential to what's going on in the world right now.

Right now, today, this afternoon, as we speak. what breadcrumbs have ever been available to lead people to the light.

The steps up to the sun, the steps up to the world, out of delusion, a thorny and broken and acidic and covered in bat guano, which is probably COVID infected.

It's a shit storm getting out of the cave.

And I've said to people from the very beginning, It could be at least months and probably years of suffering before your eyes adjust to the light and you take in with great gratitude the glory of that which is rather than that which is merely told and inflicted.

When you think for yourself rather than juggle the manipulated madness inflicted on you as pretend empiricism by other predatory people.

[12:01] God, wouldn't you love to have a world free of war and endless debt, and the endless profitability of feasting on the body politic through the insane forked tongue of endless propaganda?

Wouldn't it be just incredible that the value that you put aside doesn't slowly evaporate?

[12:30] All of our savings is meat in sunlight. Do you follow?

All of our savings are meat in sunlight and our focus, our time span has so shrunk.

We can't store anything. We have no freezers. We have no fridges.

We have no salting. We have no curing. We have no canning.

We hunt we make a kill in the analogy and we can't freeze any of the food we live in a prehistoric state with regard to our savings, we get food for a year it rots in a day, we can't store anything everything decays everything falls apart, It's like trying to live in a sandcastle, in a storm.

Everything is decaying, everything is falling apart, everything is being preyed upon.

All the savings that we have, all the wealth that we create is used as collateral to borrow and bribe.

Our wealth becomes our chains in the current system.

[13:50] That which we achieve becomes only a kind of economic noose and the savings we put aside to get married and to have children turns into giant bear traps and man traps and, hollow tubes of endless enslavement, we can't save anything we can't affect anything we can't control anything we can't trust anything nothing is plannable nothing is predictable, we're living in the mind of a madman we are bit characters in the fever dream, of a psychotic episode of the powers that be.

[14:40] We are a smudged thumbprint backdrop to a painting that is burning.

Don't you get this sense? I don't think it's just me. You can't plan anything.

And all the numbers are lies. In America, they just revised the job estimates by hundreds of thousands of people. There's so much profit in lying.

There's so much predation that nothing can be planned.

And those of us who are smart enough to want to plan or who come from cultures that had to plan for winter are in this twisted LSD chaos that chafes against all that we wish to control in the future.

Intelligence and the need for intelligence is foundationally based upon the need to predict and control the future. What can we predict? What can we control?

[15:37] Virtually nothing except. except in this realm in the realm of bitcoin.

[15:46] Now of course i said that, in the past there were no breadcrumbs to lure people to the light well hello breadcrumbs, in the past the amount of suffering you had to go through to pry pry your sticky eyes off the flypaper of propaganda was agony.

You lost eyelashes, you lost vision, you lost friends, you lost love, you lost stability, you lost income, you lost momentum, progress.

You had to fall for a thousand years to bounce into heaven.

And who survived to the fall? Not everyone, I'll tell you that.

Not everyone. Not everyone.

[16:33] Now, we have some gold coin capital B breadcrumbs.

You can leave one on every step towards the light.

[16:53] Now, we have an empirical measure of the value of human freedom, of the value of liberation from the financial matrix.

Of debt and predation.

Now, the reward, for understanding and wisdom, is both vivid and immediate.

[17:22] And people still, still think that Bitcoin is about money.

No. Bitcoin is about freedom. Bitcoin is about having control over your own life.

Bitcoin is the sword that cuts the chains of enslavement to unchosen debt.

You know it's funny I'm doing a bunch of research at the moment so what do I do I go to academics funded by my tax dollars, on websites funded by my tax dollars and they have the absolute ball busting audacity to say to me oh you want this article that you paid for well that'll be 78 dollars, It's just like me renting a car, going back to the desk and say, Hey man, I'm happy to sell your car back to you, only $5,000.

Because I'm in a generous mood.

[18:35] Now we have breadcrumbs to lead people to the light.

We don't have to drag them, we don't have to cajole them, We don't have to woo them. I don't have to twerk on the steps.

I should probably twerk away from the steps to drive people towards the steps, but you understand what I'm talking about. Twerking is involved.

I don't have to riz people up the steps.

[19:14] People are hanging on to Bitcoin like someone trapped in a cave 50 feet underwater is hanging on to air bubbles.

[19:29] Now, you understand that for most people, conservative investments in Bitcoin have been barred in most jurisdictions.

Barred. Most people are handing money over to a financial advisor, a hedge fund manager, or something like that.

And to a large degree, just my interpretation, I'm no lawyer, no economist, no expert, just my philosophical interpretation, that they have been barred and banned from conservative investments into Bitcoin.

I mean, of course, they can go buy Bitcoin in most jurisdictions and so on.

But as far as well, the information has been withheld from them, and a lot of the technical custodianship has been kept away from them and of course a lot of the scare stories about so and so lost their coins, has been inflicted upon them now there's a tipping point at one point in the movie Titanic you're crazy to get on the lifeboats at another point you're crazy not to.

[20:51] So, there is a reward for virtue that is as close and closer than it's ever been in human history.

A tangible, material reward for virtue.

In the past, life was such a shitfest, such a shitstorm, that the best you could hope for was a reward in heaven after death.

[21:17] And then you got some hard some reward for hard work and dedication in the early scientific phase in the early artistic phase in the early entrepreneurial and free market and industrial revolution phase and then oh gosh oh boy did you make a lot of money in the industrial revolution europe wow that's really cool did you end slavery good for you man good for you you made a lot of money in the 19th century Wow, that's great.

You know what we can do with that money? What could we do with that money?

Could we, I don't know, advance science, develop rocket ships?

Could we get cures for cancer?

Could we help spread peaceful parenting?

Could we do, look, you've just made a fortune.

The greatest wealth accumulation in all of human history.

To that time was between about 1750 to 1900 150 years or so wow you made a lot of money wow you historically won the infinite lottery and have staggering amounts of resources.

[22:33] Boy, what could we as a society do with all this sudden new incredible wealth?

I know. We're not going to the stars. We're not going to the moon.

We're not curing illness.

We're not educating the poor.

We're not increasing your salary. Do you know what we're going to do with all that money? Trillions and trillions of dollars that you have generated.

What are we going to do? I know. let's fucking slaughter 10 million of you and lay waste to two and a half countries how does that sound?

Doesn't that make all that work worthwhile we're gonna smash you up blow you up mustard gas you up, disassemble you starve you.

[23:29] Turn you into your component atom scatter you across the wind to the point where we're just going to have one giant tomb for the unknown soldier because we can't find even one hair of you.

Ah, that sounds good. Yeah, that sounds good. That sounds great.

Thanks for all of that wealth.

We're going to turn that wealth, all your hard work, putting your children down mines, putting your women up chimneys, we're going to take all that wealth, all of the first accumulation of massive riches in the history of humanity, and we're going to take you all apart.

[24:08] We're going to take you all apart, destabilize the entire continent, slaughter 10 million of you, and then even more in the illnesses that follow the war.

Oh, and yeah, then what we're going to do is we're going to massively inflate the currency. Then we're going to produce a 14-year Great Depression, which culminates.

Oh, how about a 4 to 6x war?

10 million, that's nothing. Let's do 40 to 60 million. Mmm, that's tasty.

Ooh, also let's use it to fund communism. We get another $100 million slaughtered out of it.

[24:49] And that's your reward for our 150 years of back-breaking labor.

Ooh, you're going to end slavery? Fantastic.

That gives us a lot of wealth, which we can then use to fund, hundreds of millions slaughtered in the cause of war.

Success is disaster, wealth is slavery, liberty is death.

Hey, good thing you had a free market. We're going to scoop all that up and use it to find weapons of mass destruction. Oh, that's going to be great.

Oh, now that you have a lot of wealth, perhaps we could use it to entrap and indoctrinate your children in the Prussian school system, which turns them into abject slaves of propaganda. propaganda.

Oh, as an added bonus, I think we'll just turn them against you as well as an elderly out of touch, bigoted generation.

Sound good? Yeah, that sounds great. It doesn't matter whether it sounds good or not. It's going to happen anyway.

Don't like dying by the hundreds of millions because of fiat currency? Bitcoin solves that.

[25:53] Oh, you don't feel like sending your hard-earned money and your children's future to some ethnic conflict halfway across the world?

Too bad, we're doing it anyway. Oh, Bitcoin solves that, too.

Fiat currency is a beheading paper cut that takes away the lives of hundreds of millions, in my view.

Bitcoin solves that.

[26:29] If you don't control your resources you don't control your life if you don't control your savings you have no freedom, there's no point putting your money in a bank if people are pulling it out through the back, that is life in the world as it is.

And it's not much of a life, and it's a whole lot of death.

So, let me just get your comments, and we will move on.

I'm going to move to supporters only for a bit more of an economic analysis.

If you would like to join, I would be thrilled if you did. I will put the link in the chat.

You really should. It's a great set of resources.

And I appreciate your tips. Thank you so much.

[27:42] And we will get there in a sec. Passionate as in shirt off. No. No.

Bitcoin, kick yourself now or kick yourself later.

[28:15] Yeah bitcoin investment managers have only looked at the cons of bitcoin now they're trump at the post to get people to invest with them, all right let's get to your recent messages now this is for donors only thank you guys so much for joining.

I really appreciate you being here. Tips, of course, are certainly welcome.

Can you explain how Bitcoin solves these problems? We had a gold standard once upon a time and there were still wars.

But the gold standard, the gold was controlled by the government.

Gold was managed by the government. Gold was legalized and not legalized by the government.

Gold was stolen and taken and you had to have a license sometimes to mine for gold from the government. gold was intensely controlled, manipulated, stolen, and preyed upon by governments.

[29:15] So, and also, World War I would have ended very rapidly if it wasn't for countries going off the gold standard and turning to fiat currency.

I mean, sorry, there's no reason why you would know this stuff.

I mean, it's fairly specialized knowledge, but it's very important.

Important. It's very important.

Once people understand what Bitcoin means, a decentralized exchange of value that is eternally limited to 21 million major tokens, it calls it shades down to the satashis.

You can centralize gold by locking it in the government building, Right.

Right.

[30:16] Honestly, if you're down to two bucks, please don't send it.

I feel bad. If you're down to two bucks, please don't send it. I feel bad.

Keep it for your ramen.

All right.

I'm happy to take your questions comments of course I have to uh I know this I just can't explain it the way you do I've been trying to convince my gold silver stacking friends so I'll be sending this video to them is the whole live stream about crypto, I don't know I mean it's your show it's your show, Tekken have you ever read The Fountainhead have you ever read a novel called The Fountainhead.

[31:11] To truly understand Bitcoin requires a level of intelligence, perceptiveness, historical understanding, and awareness that you cannot transfer.

Okay, please, I'm begging you, go read the novel called The Fountainhead.

So in The Fountainhead, there's a brilliant guy who keeps doing the work of a non-brilliant guy and destroys the non-brilliant guy by giving him the fruits of brilliance without the ability to generate and manage and sustain it.

It's a very powerful book. So you've got a bunch of friends who you've talked to about Bitcoin for years and they haven't listened.

Please, I'm begging you, give them the option to not listen.

People who aren't willing to understand Bitcoin probably don't deserve it.

People who aren't hungry to find out. People who aren't massively curious.

People who aren't pursuing you for this knowledge.

[32:14] It's like the story of Cyrano de Bergerac, right?

Where you've got a guy who's good looking but not particularly smart and you've got a guy with a big nose who's very eloquent and the smart guy tries to woo a woman by having, sorry, the dumb guy, the dumb pretty guy tries to woo a woman by having the smart eloquent guy whisper in his ear and write his letters and so on. So the woman falls in love with who?

Who does the woman fall in love with? but it's fraud. She falls in love with the fraud.

Make the case for Bitcoin.

Those who know, who've earned it through virtue, intelligence, curiosity, and a commitment to freedom.

In my view, those should be the people who have Bitcoin.

Bitcoin has required a fair amount of courage, a fair amount of staying power, a fair amount of optimism a fair amount of very radical understanding about history and economics who should have to bitcoin who should have bitcoin people who know or people who've been cornered bullied coerced into taking it.

[33:30] If you give if you if you let people or you encourage people or you give bitcoin to people who don't understand what's going on they will probably end up discrediting Bitcoin, you're probably not helping Bitcoin by trying to get it into the hands of people who reject knowledge, did you see what I mean?

[34:02] Bitcoin should be helmed by those who know the most and understand it the most deeply.

At least in this format.

Or, you know, the should is kind of a tough thing to talk about.

But I would certainly make the case that trying to convince people for years to try and understand the value of Bitcoin, I think is unproductive. And it may in fact be negatively productive.

I mean, the number of people I've told to stay away from free domain is legion, massive, huge.

Stay away, go do something else, don't rent.

Not everyone, should gain the fruits of virtue without the pursuit of virtue.

[35:08] So convince them of the moral case, but don't try and convince them to just get it and own it.

[35:23] You say, the thing is, people in the gold-silver community are so close to the understanding, but somehow can't find that understanding.

Okay, so should they have Bitcoin without understanding?

It's a big question, right? Should they have Bitcoin without understanding?

I mean, I can't answer that and obviously do what you want, right?

But there's a case. There's a case to be made.

I don't try and convince people. I mean, if they ask, I'll talk about the value.

I don't try and convince people. I mean, there are enough resources out there.

People can make the case for themselves.

How many devotees and evangelicals does it take to have a movement that changes the world more than it's ever been changed before?

People you talk into it are going to be paper hands. People who get it are diamond hands.

[36:35] All right.

So let me get to some comments.

This could be a bit more technical, but worth going over though, right? This is more for today.

Black rock black rock files registration of securities for their spot bitcoin etf with the sec approval soon this is from 48 minutes ago clean spark invests 193 million dollars in new miners looks to 5x the hash rate in anticipation of halving that's the u.s i think almost 200 million dollars in new miners.

[37:16] The Standard Chartered Bank has, according to Bitsy, funny these names, a bold forecast from Standard Chartered Bank, $200,000 Bitcoin by the end of 2025.

Nobody knows. Anybody who says this, this, this, all the math, nobody knows, right? Nobody knows.

Global banking giant Standard Chartered says $50 to $100 billion could flow into Bitcoin ETFs.

In 2024.

Now that's quite high. That is quite high.

And of course we can always imagine what that might do to the prices.

[38:05] Japanese e-commerce giant. Makari to accept Bitcoin payments. It has over 20. Million.

Million customers.

Do you not feel it all? It's happening. It's happening.

[38:28] And according to Lark Davis, just-in-spot Bitcoin ETF applicants are in their final steps towards approval.

They're all filing amended S1 forms right about now.

So here's what's standing out right now is that there's a literal fee war that is going on at the moment.

Because they're all going to try and get their customers to invest with them at the same time. And what does that mean?

That means that they're going to have to make the case for the fee war.

So BlackRock's fees will be 0.3% and 0.2% in the first 12 months or until $5 billion in volume is hit.

ARK fees are going to be at 0.25%, no fees for the first six months or until $1 billion volume.

Galaxy fees are at 0.59%, no fees for the first six months or until $5 billion in volume. William, WisdenTree 0.5% fee, VanEck 0.25% fee, Valkyrie 0.8% fee, Fidelity 0.39% fee.

All these fees are much lower than expected.

Why? Because there's going to be a big influx of money. They're expecting a big influx of money. And so they are fighting to get the first customers.

[39:41] So, this has not been seen before, not just in Bitcoin, but in the entire history of the world.

So yes the fight for customers is in bitcoin news reported this is yesterday numerous withdrawals are happening from kraken ranging from 400 to nearly 1 000 bitcoin per transaction totaling over 1 billion dollars in bitcoin so far, so that's a lot so that's a lot why would there be withdrawals because people are are diamond-handing.

They're diamond-handing.

From British HODL, understand this, there is probably not a single day in Bitcoin's history where there has been a net inflow of more than $1.5 billion long on Bitcoin, and the ETFs are about to get a mandate to buy roughly $3.5 billion in the space of five days.

With the bulk of it coming on day one, no one is ready.

No one is ready.

[40:55] And he says, C2Spark says, yeah, I've been seeing very smart technical people not get Bitcoin. They don't understand the moral case.

It's really fun to read the price predictions from five years ago.

Almost all was totally wrong.

Looks like they are pumping so they can dump. I don't know what that means.

I don't know what you're looking at. And the idea that you can read the mind of the financial elites and those who have inside information, be aware of this too, right?

I'm not accusing anyone because I don't know, but the idea to be in the position of knowing that the approval has happened is so powerful that I can't imagine that there isn't going to be some kind of jump in price before the announcement.

[41:42] So, I mean, before, when it reached, what, 69, okay, U.S., was it 2021 or something like that, there was not the same institutional furnace underneath it, right?

You understand that Bitcoin is like a hot air balloon, and the ETFs are like this flame, right?

That's what it takes it, so it takes it up. It's the heated air, right? The heated gas.

So, please, anybody who tells you that they know what the price of Bitcoin is going to be is lying, in my view, in my opinion.

Or they have inside information, which is the last thing they'd ever do is tell you, and the last thing they'd ever do is tell you.

[42:31] So people have been barred in many cases people have been barred from, uh selling bitcoin and you know etfs are maybe not direct ownership of bitcoin but you have a stake in it that kind of stuff right so people have been barred from selling bitcoin to institutional investors, to those with more conservative portfolio strategies, which tends to be the older people, which tends to be where the money is.

That's all coming down. That's all breaking apart.

All right, let me get Mr. J's document. What else do we have here?

Ah, right.

From WatcherGuru.com, CNBC expects spot Bitcoin ETF approvals Wednesday.

He says, they say, quote, the date in question also stands as a deadline for a host of prospective issuers.

However, CNBC assured that the U.S. Securities and Exchange Commission is likely to approve multiple applicants.

Currently, there are more than a dozen applications to the investment product pending. Now, What happens? For them to just approve one would be pretty terrible, because, you know, that would be pretty wretched, right?

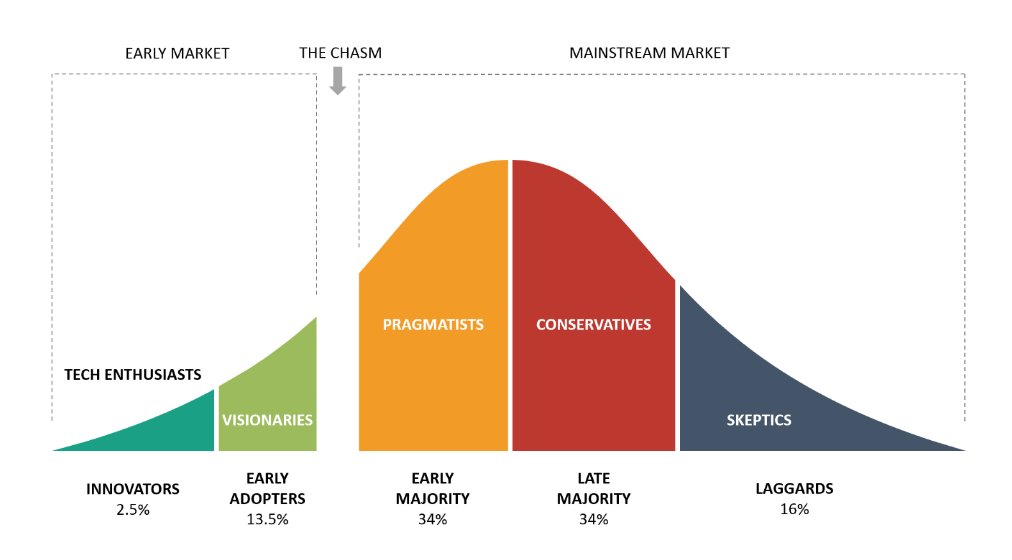

[43:59] Now, have you seen, you've probably seen this, right? This bell curve of early market to mainstream market for the adoption of things, right?

I can throw this in the chat because I, of course, was looking at this back in the 90s when I was a tech entrepreneur about the adoption of what it is that I was doing.

I'm going to throw this in the chat and you can see it. We can step along with it because that's kind of important.

I'm sure you've seen this before.

Just in case you haven't, it's probably worth being reminded of it.

[44:35] But this is very important when it comes to understanding how things grow in society.

And of course, it's very easy if you're entrepreneurial or if you are an early adopter.

I tend to be an early adopter. I love the early adoption stuff.

So let's, you can click on this to zoom it up. Let's go over this.

It's really, really important to understand where things are in the cycle.

In tech in particular, but in the economy as a whole, the future is not like the past. The future is not like the past.

I mean, I remember I was chief technical officer, no, director of technology, I think was my official title at a company, that most of what we did was to convince people with a lot of property that the future of the maintenance costs was nothing like the past, right?

You install a bunch of windows, 15 years later, they probably need to be replaced, but you haven't needed to replace them for 15 years.

So it was all about helping people budget for the future cycles of renewal, right? In the economy, the future is not like the past.

And trying to figure out the future by looking at the past is like trying to drive with your eyes glued to the rearview mirror.

It's just going to crash. Right? So let's look at this.

Innovators. So this is the general population, right? Two and a half percent of people are going to get into it because they're enthusiastic and excited and this and that and the other, right?

And then there's a 13.5% early adopters.

[45:59] Right? So there's past the innovation stage, past the massive skepticism stage.

There's been a proof of concept. And this happens to the internet, this happens to television, this happens to radios, this is the whole thing, right?

[46:11] And then there's the 13.5% are early adopters, and then there's the early majority, and they are the pragmatists.

And they say, okay, well, it's been proven, and, you know, it's kind of reasonable, and it kind of makes sense. and you know, that they, it's the old thing.

Nobody, well, it's a little bit before most, nobody gets fired for buying IBM.

It's a sort of statement in the old, in the old tech world, right?

So the big question right now, and there is a chasm, right?

And the chasm here, this is where marketing and sales and so on makes the big difference, right?

How do you get enough salespeople into the early adopter sphere to get it to the early majority where the pragmatists are going to come in, right?

[47:01] So the question, so the chasm is how do you go from innovators to early adopters further, right? So if you look at Bill Gates' shepherding of the IBM PC, got it through this to the early majority, and so on.

If you look at something like the Atari 400, 800, the Atari 520ST, the Amiga, and other things, they couldn't get past this phase.

Certainly because in the blob, in the middle here, in the hump of the bell curve, is the business world.

Right so if you can't break out of the hobbyist world into the business world you have a uh you have a challenge right so uh tell me does this sort of make make sense so far we are we are we grokking this way through so the question is are we in the chasm right and i in my view i think we're in the chasm and what takes it from the early adopters to the early majority early majority late majority that's it boom you got 68 right you got more than two-thirds of people 66.6 no No, it's 68%, right?

[48:07] 34% early majority, 30% late majority.

So once you get past the chasm and you get into the pragmatists, you're set.

Then it's maintenance because it's going to spread on its own.

[48:27] I don't think that the pragmatists have, no, the pragmatists have not adopted it yet. No, no, no.

In my view, in my view, right? In my view. you and you can see these kinds of numbers what percentage of people around the world have bitcoin, right now the chasm in my view in my experience and i have a good degree of business experience here i've been involved in i've been involved in building building tech products i've been heavily involved in selling tech products i've been a director of marketing for tech products so i know a lot about this sphere i mean there's things i don't know much about but in this sphere I know.

Now, how do you get across the chasm?

How do you get across this chasm? To the point where you start to get the pragmatists who don't care about the ideology, who don't care about all of these sorts of things.

[49:18] But they just want what works, right? So the tech enthusiasts are the people building their own Sinclair ZX80 or whatever it was, their own Sinclair computers with 2K RAM.

That was me learning how to program a PET computer with 2K of RAM and sinking all of my money in my early teens that I inherited into buying a computer and learning how to program missile player graphics on the Atari 800 and meeting a guy in a parking lot to get 32k of ram that he basically produced from a pocket inside of his uh coach like a watch thief, um and you know because you always want to buy your memory in a parking lot from a guy named luigi in a windowless van so yeah these are these are the visionaries uh innovators and then early adopters the pragmatists are when you can make a business case now can you make a business case yes you can like finally with and this is what i mean when i say there's finally breadcrumbs, that you can put on the stairs to lead people out of the matrix.

So the pragmatists don't care about the ideology. They don't care about the technology.

Can you make a business case? So when I was first programming my software, which ended up selling for a million dollars plus in some instances, when I was programming my software, I was keen, thrilled, excited.

I thought everything was really cool. I loved the tech. I loved the vision and what we were doing and all of that.

[50:36] And so we got a couple of people, early adopters, people also fascinated by the tech who just, oh, you know, I've got a fair amount of charisma, so they liked working with me as well.

But then the chasm is, can you make a business case?

So people not invested, they don't think it's cool, they don't care about the technology, can you make a business case?

So in the case of my software, we partnered with other companies.

I won't get into all the details because it's long ago now. now, but basically, we could make a business case that the cost of the software would pay for itself in six to 12 months. Everything after that was gravy.

And because you've had the early adopters, what you do with the innovators, you build the thing, the early adopters, what you do is you get them to buy the software or the product, and then what you do is you relentlessly track the profits and the savings that they get from your software.

And then you use the early adopter business cases you get from the early adopters, you you use to launch over the chasm to get into the early majority.

Because you have references, you have a business case, and you have proof.

And you have proof. Now, the fact that Bitcoin has been the best performing asset in all of human history is a pragmatic case.

You don't have to study Austrian economics. You don't have to understand the history of fiat currency. so you don't have to understand what happened in France in the 18th century or Rome post-2nd century. You don't have to know any of that stuff.

[52:06] The numbers don't lie. The value doesn't lie.

Now, why am I saying all of this? Because I love the sound of my own voice.

[52:20] What gets Bitcoin across the chasm?

What gets Bitcoin across the chasm?

What gets Bitcoin across the chasm is sales and marketing.

And what the ETFs provide is sales and marketing.

The pragmatists care about the cost benefits, right?

The innovators care about the technology, the visionaries care about the ideology, do the pragmatists care about the cost-benefit ratio?

The conservatives are willing to take a lower profit in return for greater stability.

[53:13] What the, it's not that the, I made this case a couple of weeks ago, so I'll keep it brief here. In my view, it's all just my opinion, right? None of this is advice.

But in my view, and it's not an uninformed view, but you know, it's still my view, my opinion.

So, the value of the ETFs is not all of the money that's going to flow into Bitcoin.

That's not the value. The value of the ETFs are the emails, the brochures, the seminars, the phone calls, all of which are going to make the value proposition for Bitcoin, which formerly the financial industry has been making against Bitcoin.

Does this make sense? Now that the financial industry can profit from Bitcoin, rather than be threatened and bypassed by Bitcoin, they are going to pour massive amounts of resources into evangelizing Bitcoin Bitcoin for the more conservative?

Yes, some of them are the boomers and so on, right?

Is there a second value, right? I don't think so. I don't think so.

Because Bitcoin has so far successfully, to a large degree, solved the problem of scalability in other Bitcoins. Oh, they're faster because they've got fewer users and so on, right?

[54:36] It's the mass communication to the general public that gets you over the hump from visionaries to early adopters the early majority now i don't think there's any particular individual who has the credit because i mean the people in the early, adopter, the innovators, they're tech heads, they can't talk to people.

The early adopters sound insane.

Because there's, I mean, I get, so was I, right? The early adopters sound insane, because when I'm talking about the end of war and, you know, the liberation of the next generation from financial enslavement and being control over your time, it sounds insane.

I get that. I mean, that's fine. I'm supposed to sound a little nuts because I'm right on the forefront, right? If you're not sounding a little nuts, you're not far enough ahead, right?

[55:34] So how are you going to talk to the majority? And of course, anybody who was really good at talking to the majority got marginalized by the media.

And the media is going to have a hostility towards Bitcoin Bitcoin, because a lot of what the media does is justify the spending of fiat, or the allocation of fiat, and so on, right?

They won't have nearly as much to talk or write about with regards to a non-manipulatable currency or store of value like Bitcoin.

[56:14] Like the girl who likes spreading gossip doesn't like hanging around with the girls who reject gossip.

Oh, look, it went up again. We are now at almost 63,000 Canadian.

Because I think what people are doing as a whole, I don't know, obviously don't know, but I think what people are doing is they are anticipating the great communication.

So you have senior people at major, major financial institutions who've risen to the top because of their uncanny doctor-do-little ability, to financial fleet whisper hot secrets into the boomers' hairy ears.

Boy, that's quite a sentence, isn't it? Sometimes they just come out like a bunch of refugees streaming from a sinking liner.

[57:07] Yeah, Edward, that's a better way to put it. Thank you. Bitcoin helps take all the violence out of the world and the media profits off violence.

So yeah, thank you. That's much better than what I said, and I appreciate that improvement. Very important. Thank you.

So Boomer Whisperers are now going to have massive motives to explain the value of Bitcoin to those with the most assets, the most resources, and the most caution.

Jay Lano says, had a coworker recently tell me that Bitcoin is a scam.

I just smiled and said, okay, it's not my job to convince him.

Yeah, hey man, you think it's a scam?

Then don't own it. Absolutely. I will not convince people who don't think to own Bitcoin because then they will be thoughtless with their Bitcoin and harm its reputation.

[58:03] I don't plan to think is not the basis for an education in philosophy. Right? So.

So what's happening is the communication from those who have now 30 to 40 years experience being fantastic educators of conservative investors on challenging value propositions.

The people who are going to sell Bitcoin ETFs to the boomers are the same people who sold internet stocks to the boomers, who sold housing futures to the boomers who sold just a wide variety of challenging financial structures to the boomers.

And those who grab this market are going to make a fortune and they know that. And they know that.

[59:03] The greatest communicators of complex financial instruments are about to whisper by the millions, well, maybe not whisper, to speak loudly into the hairy ears of the boomers.

And that is going to change. Now, the other thing about a lot of people who are older is that they grew up without counter-narratives.

This is kind of important and this is kind of subtle, so hopefully this will make sense. And so a lot of people who are older grew up without counter-narratives.

And what that means is that they don't notice when the narrative changes, right?

So we sort of social media kids, we've grown up, well, I didn't grow up, but you guys have definitely grown up with counter-narratives.

Well, they say this about George Zimmerman. Well, but the media, the alternative media provides this alternate explanation. Well, they say this about McCarthy.

Well, but there's an opposition to the McCarthyism was just a fantasy, right? They say this about the start of the Vietnam War.

Well, but there's all of this. They say this about JFK. I understand.

So we're used to counter narratives.

[1:00:07] But that's not the older generation. I'm like under the boomers by a year.

So I'm close enough to see.

So among the older people, oh, just broke 63,000. Look at that.

So among the boomers, their weather rains.

[1:00:27] All you hear are the rusty breezes pushing around the weather vane Jesus.

It's the 1984 thing. They don't notice really a change in narrative.

They're just used to following whatever the predominant narrative is, and they don't reference prior narratives.

I don't know if you've noticed this, but they can be talked into and out of just about anything.

Thing right i mean these are the people to whom uh i don't know ukraine was like bad and then ukraine becomes good they don't seem to notice the difference uh they heard the left really proclaim the value of free speech before the left was in control of institutions and now the left is censorious in an almost unmatched way they don't notice the difference right, They heard Martin Luther King talk about judging people by the content of the character, not the color of their skin, and then you ended up with a race-obsessed society. They don't seem to notice.

So, when the narrative shifts, and this, again, brilliantly captured in 1984, although 1984 was completely false with regards to what was actually the threat, but it really gets there.

[1:01:49] So normally people would say when the narrative shifts on bitcoin normally people would say to their financial advisor it's like well wait a minute you told me a year ago the bitcoin was too risky and now you're telling me it's great it's fine right that's what you and i would do, but you know whether it's sad or happy good or bad doesn't it's a fact of life like gravity gravity is that when the narrative reverses on Bitcoin and the boomers are told it's the greatest thing since sliced bread, they'll be like, great.

I mean, I don't get the mindset. I really don't. It drives me a little crazy.

[1:02:25] There will be a switch, there will be no acknowledgement of prior caution or opposition, there will be an embrace, and people will be just fine.

Edward says, the boomers have never had a counter-narrative in the financial markets, either as their whole life took place under a secular bull market in bonds and a whole lifetime of lower interest rates.

This is the first time they've had to take on board a counter-narrative in order to survive.

I wouldn't paint too wide a brush, Edward, sorry. I was there 5,000 years ago.

I was there 3,000. I was there when a friend of mine had a 23% mortgage in the 80s or early 90s or something like that.

I was around for the internet crash in the 90s, of course, the 07-08 financial market crash.

I was there in what seemed like pretty hyperinflation in the 70s and 80s when I first came to Canada in 1977.

Candy bar was a dime. It was 10 cents for a candy bar. And then it just went through the roof. It didn't even seem, it seemed to blink and it was like a dollar.

So, I don't think that the boomers have just seen nothing but easy, positive financial returns.

That's not the case at all.

[1:03:35] Now once you get to the pragmatists your work is largely done i mean there's still maintenance you still got to spread because the conservative need an accumulation of business cases in order to buy in right they need to see a stable line they need to see less variation and so on and of course there will be less variation as more and more financial players plunge into the bitcoin market the more hedging and controlling and managing the stability of the price not consciously but as a result of just not wanting to lose their shirts uh that's going to be the case right now, um i don't want to overtax your uh thoughts yeah so my parents and people in the age range had more than 20 of their mortgages yeah don't don't paint the boom like everyone's lived with this chaos. The boomers didn't have everything super easy, right?

So, do they bother with irrationalization for the narrative change?

No, not really. No, not really.

Not really. There's no pushback, so why would you bother? You don't have to explain something that nobody's asking about, right?

[1:04:52] Now, another thing that's going to be quite interesting, I think, this is sort of the last point I make, I'm happy to take some questions, although there's not much I can probably answer because these are all just my opinions, but I will tell you what I think is going to be the most fascinating thing about all of this, is that this is going to start to, the more that financial institutions get involved in Bitcoin, the less leverage, is going to be common.

[1:05:19] In my opinion, I have no idea. I have no idea.

It's just my absolute rank idiot opinion. So, but it's going to go something like this.

So if a company loses a massive amount on fiat currency, they can just run to the government to get more fiat currency, right? We know there's all of that, right?

[1:05:35] What happens if companies lose a bunch of money on Bitcoin?

I mean, they can go to the government and try and get fiat currency for sure, but they can't run to the government.

I guess they could. It depends what the government's doing with all the Bitcoin it sees, but can financial financial institutions run to the government to get more bitcoin in a roughly ideal bitcoin universe well the answer to that is no well of course not of course they can't because the government can't just make bitcoin the government can make fiat currency by the stroke of a pen the typing of a you know your numeric pad is your economic genius right type whatever you want into your own bank account but with bitcoin they can't be backstopped by the government in the same way right so if a company messes up a short and loses a thousand bitcoins they can't run to the government for a thousand bitcoins did you follow me if they lose uh 10 million dollars they can run to the government and get 10 million dollars either in a loan or whatever it is right And of course, I mean, a lot of the loans were paid back after 07, 08, or whatever, right? But they can't backstop fiat.

They can't backstop Bitcoin with fiat.

[1:06:54] So they're going to be more, I think they're going to be more conservative in the Bitcoin space than they were in the fiat currency space.

[1:07:16] Sorry, Tuckin. It's an annoying question. It doesn't mean that you're annoying.

And it doesn't mean the question is inherently annoying. Let me be more clear.

I'm annoyed by your question. It doesn't mean you're annoying.

It doesn't mean you're not totally right to ask it.

But it's a really annoying question to me. What do you think is the biggest threat to Bitcoin being destroyed or corrupted?

Compared to what? compared to what?

You're like somebody standing on the edge of the Titanic as it's sliding into the great dark.

It's going to freeze your testicles into iceball castanets.

And people are saying, hey, hey, hey, come, we've got space for you on the lifeboat.

And you're like, well, what is the biggest danger that the lifeboat could face?

What would it take for that lifeboat to sink? It's like, do you know where you are?

You're on the Titanic. Get in the fucking lifeboat.

But the lifeboat could sink. There could be a razor-tooth cannibal on board.

I might have an epileptic attack and wobble over the side of the lifeboat.

A sudden war might be declared, and the lifeboat could be torpedoed.

A giant volcanic bubble could arise from the depths and burp the lifeboat into smithereens.

[1:08:44] You got a better plan, do you have a better plan, do you have a better plan.

[1:08:56] Listen, there's caution, I get that, I mean, I live my whole fucking life, as a public square, in caution, I get, I understand caution, man, I'm there with you about caution, I really do, I understand about caution, but holy shit on a stick man, talk about poisoning the well, you understand that while you're dithering on the deck, someone else is going to take the lifeboat and your seat and you go down with the ship.

In my view, that's why it's annoying.

[1:09:28] Like you're on fire, someone's coming along with a bucket of water and he's saying, whoa, whoa, whoa, whoa, whoa. Has that bucket of water been boiled?

Is it distilled? Is it vitamin water?

Water it's like you're on dude you're on fire you're at the top of a tall building and it's burning and there's no escape and some guy comes up to you with a ladder and like whoa, i don't know about that ladder man it's held your weight but you know you're surrounded by fire, again maybe this is my i'm totally willing to be corrected on this but what the hell are you talking about oh my god here you're you're up in this high building we've got this trampoline it's gonna well what if i miss the trampoline it's like hey you're gonna burn to death.

[1:10:27] The plane's going down. What about this parachute? Well, you know, what if I land on something sharp?

Or what if the parachute is, you know, not opening in the right way?

And what if it's like, what are you doing?

[1:10:44] I'm not trying to troll, but perhaps precious metals would also be a viable lifeboat.

Again, I've made the case before. you can check out my debates with Peter Schiff from many years ago about the viability of crypto versus precious metals.

I can't tell you what to do about that.

But this is why it bothers me. Is that everyone says, precious metals!

Oh, I'll just get gold! Okay?

Are you going to have somebody else hang on to your gold? What happens then?

What happens if the government seizes the gold? You know they do on a regular basis throughout all of human history.

What happens if someone gets to an asteroid and discovers a trillion tons of gold? Right?

Are you going to store the gold in your basement? Are you going to store it somewhere? What's the cost of storing gold?

Some people say a percent a year, two percent a year, so your gold is still decaying in value if you're going to keep it protected or somebody else is going to hold on to it, in which case what if they go bust and you can't get your gold?

So everyone's always like, well, what about the risks in Bitcoin?

Bitcoin like there's something that's not risky. God.

[1:11:57] You know, it's like people saying, well, Steph, you exercise a lot, but you know, you could pull a muscle.

Yes. Yeah, I absolutely admit. I absolutely admit there is risk in exercise.

Compared to what? Show me a risk-free day and I'll show you a guy already in the grave.

[1:12:20] It's just that all of this FUD, fear, uncertainty and doubt simply cloisters around Bitcoin like there's this magic solution, called gold or silver or whatever that just erases all risk no it doesn't, no it doesn't, Bitcoin has gone up thousands of times more than gold, over the last 15 years. Probably hundreds of thousands of times, maybe millions of times, I don't know. They start off at a penny or something, right?

So you say, well, I took the money and I was conservative and I was safe and I put the money in the gold.

And my $10,000 is now $10,000 and one as opposed to $10 billion in Bitcoin.

Do you understand that holding the gold relative to the Bitcoin was a massive risk?

[1:13:18] One major advantage Bitcoin has over gold, says Edward, is the inelastic supply.

No matter how high demand gets, there will be no additional supply.

How do we handle relationships after Bitcoin moons? Don't know how family and friends are going to react. My conscience is clear because I've been telling them for years.

Just wondering how philosophy handles a sudden increase in wealth.

Oh, Steph did a two-part Truth About Bitcoin 10-Year Update spring of last year.

They addressed some of these questions. questions.

Jared, what was the price of Bitcoin when we did that presentation?

[1:14:04] How do we handle relationships after Bitcoin moves?

I'm sorry, you still have people in your life who don't get Bitcoin?

I don't really understand.

I know that sounds elitist. I know I get that.

It sounds elitist and all of that, but why would you have people in your life who don't understand freedom, fiat, government, Bitcoin, liberty, enslavement, debt?

Like, why would you have people in your life who don't understand these things? Duh-duh-duh-duh.

You know, it's like having a bunch of people in your elite orchestra who are very good at bashing their fucking foreheads against tambourines.

Look, I'm adding to the music.

I'm sorry, I don't understand.

Why would you have people who aren't on the same ride? Who are on the opposite ride?

All you're doing is, they're just going to get resentful, right?

Oh my gosh.

[1:15:24] All right. Summary from Bruce Fenton.

[1:15:30] So, that's not to talk about the ETF bringing in assets which buy a Bitcoin and raise the price.

There's something much more interesting, the financial advisors.

This is the kind of stuff that I'm talking about.

There are over 620,000 SEC FINRA licensed investment professionals.

I'm one of them, says this guy in the US. Thousands of broker-dealers and there are over 15,000 registered investment advisors.

How much money do these groups manage? Almost all of it. Trillions of dollars.

Yeah, yeah, we all know it's a deck of millions of clients and lots of assets already, but here's the neat thing.

These thousands of family office managers, brokers, financial advisors, and RIAs are mostly not involved in Bitcoin or well-versed in it, but they will be.

Things will change radically for several reasons. Financial advisors follow the money and follow the trends.

Advisors are smart about money, motivated to learn. They need to keep up with what customers and the public is talking about.

There is pent-up professional desire by advisors who like Bitcoin or are a bit curious. Curious, that's good.

But you can't justify the time to focus on it due to focus on products they're allowed to offer and make a living from. They like to make money and do well for clients.

They believe in well-balanced blended portfolios and the best advisors adjust to risk or hedge based on its performance and correlation with markets.

Over the last decade, Bitcoin belongs in many more portfolios.

Speaking of which, thousands of financial planning and asset allocation software products will add the Bitcoin ETF so advisors can do analysis and add it to hypothetical and real portfolios.

Here's an even bigger one, he says. says, these big investment firms will spend billions marketing these Bitcoin-based investments to their clients.

[1:17:00] As I've been saying for months, right? You think these companies are going to sit here hoping to win in assets after all this work?

No, they're going to do what Wall Street does better than anyone.

They're going to sell these investments.

Have you ever been on the receiving end of somebody who's just calling, just calling, got to buy this, got to buy this, right?

I mean, they're relentless. They're relentless. Lentenists, they're sharks on a seal, man. Good for them.

[1:17:25] They will have chief economists and experts and CEOs talking about this.

They will have the best ads we've ever seen, the most sophisticated and well-presented narratives.

They will spend millions educating the public about why this makes sense as part of their portfolio.

The investment companies even hire what are known as wholesalers.

These are like super salesmen who sell to the sales force.

They travel from office to office with a blank check, food and beverage budget meeting brokers, buying lunches and telling the brokers and financial advisors why they should put clients in this product. product.

The wholesalers know the topic calls and are available to help on the high end sales.

They also provide brokers with financial support advertising materials already compliant, compliance approved PowerPoints and mailers and educational materials.

Yes, the financial advisors will get up to speed.

On Bitcoin, they will have no choice. And you know, probably some of them will use our presentations here.

And here's where it gets exciting. As all these thousands of financial advisors learn about Bitcoin, what will happen? Many will get it.

They will see Ross Stevens and Syfie Dean and Saylor videos.

They will read the books. They will follow crypto Twitter and go to conferences.

They will get the narrative. Some will become true believers.

The next great supporters and proponents of Bitcoin don't even believe in it yet.

In 10 years, some billionaire may be saying, man, I was late.

I was at a big bank and not allowed to touch it until the ETF.

So I didn't learn about it much until 2024.

[1:18:43] So, yeah, it's something, man. It's something.

This is the equivalent in financial terms of the translation into the common tongue and the mass publication of the Bible.

Oh, so Bitcoin's price was about $28,000 when we did the truth about Bitcoin last year.

It was about $28,000.

So, let's see, it hasn't doubled, right?

BTC, USD, what do we have? 46, it's almost 47, right?

Let's see here.

47,000, to mind of my...

Yeah, so, it's 1.67x.

Yeah so it's gone up almost almost two-thirds uh since then but what do i know i'm just an amateur idiot what do i know no financial advice will ever be given here.

[1:20:01] Oh my gosh oh my gosh all right any other oh somebody says uh edward says i used to work in in a brokerage talking to retail investors every day.

The funds, you got 43K? I got more than that.

You got 43K where you are? No, I got 46.9.

Don't, don't mal-information me, New Jersey boy. 28K to 43K, I got 46.9.

I'll give you the link right here.

All right. So Edward says, I used to work in a brokerage talking to retail investors every day.

The funds they always invested in were simply the ones that had the highest percentage return on a recent timeframe.

When the Bitcoin ETFs outperform every other fund, they would be like moths to a flame.

Yeah. And so you have those with the gift of the gab joining together with those of the gift of the tech and those with the gift of the moral mission.

And it will be staggering.

We've never seen anything like it in this level of rapidity.

In this level of rapidity. All right, any other last questions, comments, or, you know, a tip or two, if, you know, if this has been helpful in any way over the last 14 years.

[1:21:24] Any other last tips? Or, if you're listening to this later, free domain dot com slash donate.

Do you guys mind if this goes out to the general population?

I wanted to have a more private chat with you guys about this, but do you mind if this goes out to the Gen Pop as a whole?

I hope you don't, because I think it's important and helpful to try and make this case.

[1:21:49] Yeah, honestly, this is, Blues Brothers, we're on a mission from God.

Yeah, honestly, this is a mission from God to just the money tables, right?

Thank you, Edward. I really, really appreciate that. That's very kind. Thank you.

Yeah this is a salvation of mankind stuff i mean you can look at my speeches from like 12 years ago 10 years ago it's uh gotta go uh fiat currency is uh a decapitating paper cut, so all right well thank you everyone so much for listening and watching um i was hoping to get to the truth about sadism tonight but uh i may not i may not because that'd be a lot of work to do as well and i had to do a fair amount of prep for this and uh the time flies release it in a few months oh oh there's i can do the truth about sadism and there is somebody saying release this in a few months well there's the truth about sadism right there all right well thanks everyone for your tips i appreciate that have yourselves a wonderful afternoon and evening and you know it's kind of neat to not be in the public square as much anymore otherwise i'd be getting massive amounts of bookings to come and tell financial executives about bitcoin because i really can can talk the finance stuff because I worked in a brokerage house.

I've done the marketing. I know the tech.

So it's good to be doing it this way rather than jetting all over the place and missing the call-in shows. All right.

Thanks, everyone. Lots of love from up here. Take care. I'll talk to you soon. Bye.

Support the show, using a variety of donation methods

Support the show

Recent Comments